Is your business ready to say goodbye to paying for fuel the old-school way?

Are you ready to put an end to tedious administration tasks and manually managing your fleet’s fuel expenses? Do you want to save time and money on the running of your fleet?

If your answer is yes, then good. That’s the right answer.

Now all you need to decide is whether you want a single-branded or multi-branded fuel card… but let’s take a few steps back, first.

Save 6c/l + $0 card fees in promo period

Save up to 6c per litre on fuel for your business

Why You Need to Stop Paying for Fuel with a Credit Card

Credit cards have been around since the 50s, so of course we’re comfortable using them for everyday business transactions, including fuel.

However, credit cards aren’t the best way to pay and manage your business’s fuel expenses. There are next to no benefits to using a credit card to pay for fuel. You know what does come with great benefits? A fuel card.

Here’s a comparison table to show you just how far your business can go with a dedicated fuel card, and why it’s time to ditch the credit card when paying for and managing your fleet’s expenses.

| Fuel Card | Credit Card |

| ✅ Generous fuel discounts | ❌ No access to fuel discounts |

| ✅ Increased security and prevention of fuel card fraud with fuel cards linked to driver and/or vehicle | ❌ Cannot link a credit card to specific driver or vehicle |

| ✅ Restrictions on what employees can buy (i.e. just fuel or fuel and in-store purchases) | ❌ Employees can buy whatever they’d like with a credit card |

| ✅ No need to keep receipts – monthly consolidated invoice | ❌ Receipts must be kept for invoicing/tax purposes |

| ✅ Reduced admin time and cost | ❌ No reduced admin time and cost |

It’s a no brainer, right? Let’s see how much your business can grow with a fuel card.

5 Ways Your Business Will Thrive with a Fuel Card

1. Reduced risk of fraud and misuse

With a fuel card, YOU control who uses the card (e.g. a named driver), or which registered vehicle it is assigned to. You can also restrict card purchases by value, fuel volume or what day of the week it can be used – even specific timeframes. Not to mention you can choose the type of fuel drivers are allowed to fill up with. A credit card won’t give you any of these controls that reduce fraud and misuse.

2. Handle your accounts with efficiency and simplicity

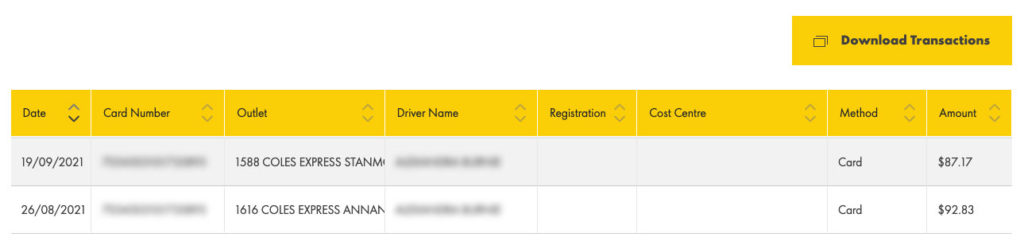

Tired of manually sorting through your credit card statements for fleet expenses? Manually completing this task wastes time and money, and is a step that can easily be removed when using a fuel card. With a fuel card, you receive monthly consolidated reports of all your fuel-related expenses. You can even drill down into specific data like looking at specific drivers or vehicles. Plus, most fuel card providers send ATO-compliant invoices, so you can say goodbye to tedious filing and admin tasks. Can’t do that with a credit card, can you?

3. Improve your bottom line

Depending on which fuel card provider you choose, watch your savings and business efficiency grow with a fuel card. With often-times generous discounts on fuel (and other vehicle-related expenses), a fuel card can also help you analyse spending so you can find opportunities for great business savings and efficiencies, ultimately helping you improve your bottom line.

4. Clamp down on wasteful driving with detailed reporting

Fuel cards can provide data you didn’t even know you need – like data that will help your monitor filling up patterns to clamp down on wasteful driving and excessive filling up. Of course, you don’t get this kind of in-depth data detail with a credit. Monitoring filling up patterns is a particularly useful feature for larger fleets, where even the smallest of savings can mean huge financial gains.

You can also monitor who is filling up when and where, and set alerts for drivers filling up outside the allowed window. This helps prevent fuel misuse and unauthorised filling up.

5. Track Your Fleet in Real Time

Many fuel card providers partner with telematics solutions to give you real-time data on the whereabouts of your fleet. Telematics is essentially the GPS tracking of vehicles, so in addition to managing costs and expenses with a fuel card, you can also track your fleet in a live environment.

FAQs About Fuel Cards

What is a fuel card?

A fuel card works like a credit card in many ways. It makes it easy to pay for and keep track of your business fuel expenses. It means your employees can pay for fuel without cash and without needing to submit a fuel reclaim. The fuel card is attached to an account and when an employee fills up, the cost is charged to that account. The amount owing will then be deducted from your linked bank account or credit card, usually monthly.

How much do fuel cards cost?

The cost of a fuel card depends on many factors, including the provider you choose and how many cards you need. You can expect a fuel card to cost anywhere from $1.99 per card per month up to around $6 per card per month. Some providers don’t charge monthly card fees and instead charge an annual fee.

Can any business use fuel cards?

If you have an ABN and you’ve been in business for a year, you’re eligible for a fuel card with most providers. Some providers stipulate two years in business, while others have no time frame on how long you need an active ABN. Whether you’re a two-person or two hundred person business, chances are you’ll greatly benefit from a fuel card.

Should I get a multi-brand or single-brand fuel card?

This really depends on your individual business needs. Do you want better fixed fuel savings? Or do you want peace of mind your drivers can fill up anywhere? Do you have a preferred fuel card merchant? Or are you happy for your drivers to have the ease of filling up at any station? There are pros and cons to each, and it really comes down to what’s going to be the right fit for your business and employees.

Looking for a change?

Save 6c/l + $0 card fees in promo period